The United States has accused China of betraying a fragile trade truce reached earlier this year, in a sharp escalation of rhetoric between the world’s two largest economies.

In a rare joint appearance in Washington, US Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent condemned Beijing’s decision to tighten export controls on rare earth materials, describing the move as an act of “economic coercion” and a “power grab” aimed at dominating global supply chains.

“If China wants to be an unreliable partner to the world, then the world will have to decouple,” Bessent said on Wednesday.

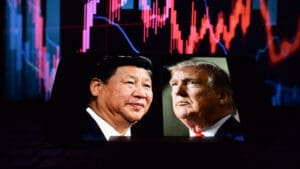

The unusually direct remarks underscore the mounting strain between Washington and Beijing ahead of an expected meeting between President Donald Trump and Chinese President Xi Jinping later this month.

China processes around 90% of the world’s rare earths and magnets — materials crucial to the manufacture of smartphones, electric vehicles, wind turbines, and advanced defence technologies.

Under new rules announced last week, foreign companies will need Chinese government approval to export products containing even small quantities of rare earths, and must disclose their intended use. Beijing has also moved to restrict exports of graphite and lithium batteries, key components of electric vehicles and consumer electronics.

Greer described the scope of the measures as “unimaginable”, adding that it was “unclear whether such sweeping controls could even be implemented in practice.”

“We are seeing a level of overreach that the global economy simply cannot absorb,” he said.

In response, President Trump has threatened to impose 100% tariffs on all Chinese imports beginning next month and is preparing new export restrictions on critical US software. Greer confirmed that these measures are currently being drafted.

Both sides have already introduced new port fees on each other’s vessels this week — a symbolic but tangible sign of rising tension.

Bessent said the White House had already received calls from US carmakers worried about potential supply shortages.

“This is China versus the world,” he said. “We and our allies will neither be commanded nor controlled. We are not going to let a group of bureaucrats in Beijing try to manage the global supply chain.”

While his tone was combative, Bessent also hinted that diplomacy remained possible: “I believe China is open to discussion, and I am optimistic this can be de-escalated.”

The latest flare-up threatens to unravel the trade truce the two sides struck in May, which suspended tariffs as high as 145% that had effectively frozen bilateral trade.

Since then, US imports of Chinese goods have still faced an average 30% levy, while Beijing imposed new 10% tariffs on American exports — a delicate détente that analysts say was always vulnerable to political pressure.

Greer said the US had “lowered tariffs since that time”, but accused China of “expanding its export controls” instead of reciprocating.

Analysts warn that a renewed trade war between the US and China could disrupt global supply chains already under strain from geopolitical tensions, energy price volatility, and a slowdown in global demand.

“Rare earths are the linchpin of modern manufacturing — from semiconductors to renewable energy,” said Lydia Grant, a senior fellow at the Atlantic Economic Council. “If this turns into a tit-for-tat conflict, the repercussions will ripple through every sector that depends on advanced technology.”

Both governments face domestic pressures to appear tough ahead of key political moments — with Trump keen to demonstrate economic strength ahead of next year’s election, and Beijing focused on shoring up its slowing economy amid weak industrial output and youth unemployment.

For now, both sides say they are open to talks. But as Bessent warned, “substantial actions” remain on the table if China does not roll back its latest export controls.

Read more:

US blasts China as ‘unreliable partner’ amid escalating trade tensions