Republicans criticized President Biden for his huge spending and deficits, which spurred inflation and jacked up debt to dangerously high levels. The GOP are now in the driver’s seat and must reform the budget to ward off a fiscal crisis. Inflation is ticking up, borrowing costs are rising, and annual interest spending is now so huge it surpasses defense spending.

Last week, the House Budget Committee released a plan to extend the Trump tax cuts, boost spending on defense and security, and trim other spending. But the plan would make the government’s debt crisis worse! Debt held by the public would rise from $30 trillion in 2025 to $54 trillion by 2034. That huge 2034 debt load would be even larger than the $50 trillion in baseline debt projected by the Congressional Budget Office.

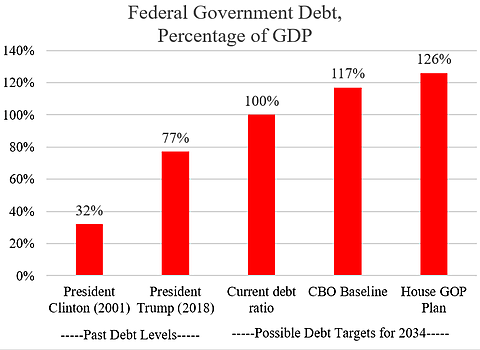

Many Republicans are not grasping the seriousness of the coming fiscal crunch. Relative to the size of the economy, reckless spending since 2001 has pushed federal debt to almost the peak reached during World War Two. The debt fell after the war, but today it is spiraling upwards even with steady economic growth and without a war.

With control of the House and Senate, now is the time for Republicans to cut. They should eliminate dozens of agencies that spend on activities that should be handled by the states or the private sector. President Trump appears open to major reforms, including abolishing the Department of Education. Congress should jump on the opportunity and deliver major downsizing legislation to the president’s desk.

How much should Republicans cut? The chart shows possible 2034 debt targets measured as a percentage of gross domestic product (GDP). A good target would be to cut spending enough to stabilize debt at the current 100 percent of GDP, which would avert a debt crisis.

Another goal would be to limit debt to no more than the CBO baseline. But in that case, we would still be on an unsustainable path with debt rising to 117 percent of GDP by 2034.

Remarkably, the House Budget Committee chose a path of even larger debt growth than the CBO baseline, thus hastening the coming fiscal crisis. The plan would cut taxes by $4.5 trillion by 2034, increase defense and security spending by $300 billion, and cut other spending by a paltry $1.5 trillion. The net effect would be to boost the debt to 126 percent of GDP by 2034.

Without any law changes, total spending over the next 10 years (2025–2034) is projected to be $86 trillion. The GOP plan to cut spending by $1.5 trillion would be just a two percent cut. That would be pathetic, weak, and nowhere near enough to meet the nation’s massive fiscal challenge.

Americans voted for Republicans to tackle overspending, debt, and inflation. This year, Republicans can pass major spending cuts with majorities in the House and Senate. They have a supportive president in Trump and the tailwind provided by his DOGE initiative. Republicans must seize the moment.

Cato scholars examine the House and Senate budget plans here and here and propose major budget reforms here.